Help Me Filling Out the FAFSA Step by Step Process

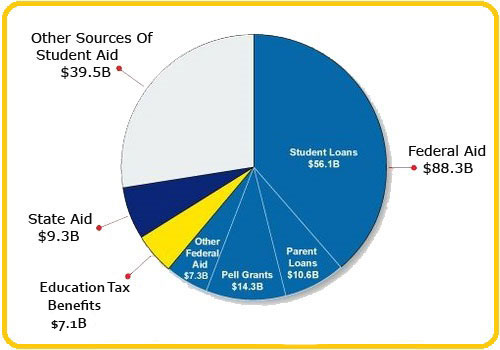

An estimated nearly 14 million financial aid applications are processed; of which eight million students take assistance in some or other form of Federal Financial Aid, where about $ 80 billion are disbursed. Individuals interested in availing these financial aid need to register themselves with the federal government's Free Application for Federal Student Aid – FAFSA

What is FAFSA?

This is a process for determining the eligibility of programs ranging from Pell Grants to student loans, for most of the states and college based financial assistance across the country. It is also one of the active sources, in some way to assess the eligibility with regards to a few merit-based help. It is so because several schools set aside their own and limited scholarships for students who fall short in meeting the criteria for need-based funds. Financial and personal details provided by an individual play a major role in determining the eligibility of that particular individual's share in federal financial aid through FAFSA.

Federal processors assess the data, decide your family's ability to pay, and then tell you how much you and your family should contribute towards college, aka your Expected Family Contribution.

The FAFSA perquisites are of five categories:- List of the schools eligible to get FAFSA results

- Information about the student

- Details on student's dependency status

- Details about the student's finances

- Details about the student's parents

- Nine federal student-aid programs

- 605 state aid programs

- most of the institutional aid available

Individuals may apply all the way through postal facility with a paper form, however; the Federal Student Aid office recommends online application forms as the online system is equipped to conduct prompt accuracy of the details submitted. The online process also helps to speed up the application considerably. In addition, individuals who apply online have the facility to save their work, if incomplete and return to saved application in a stipulated time frame.

In a nutshell, nearly all financial aid is linked to FAFSA and hence individuals are advised to complete the form in due course of the deadlines prescribed for respective schools, they applied for. Please take a not that usually state deadlines tend to be in advance as compared to June 30th, that of the federal deadline

Some of the common questions that all the applicants or aspiring students face are:

- Who would help me filling out the FAFSA?

- Is it worth comparing school aid offers?

- How to apply for aid and pay for your college?

- Which are the documents needed to complete the FAFSA?

What is the difference in FAFSA.gov and FAFSA.com?

It has been observed that, in last few years filling out FAFSA form has proved to be a meticulous task for most of the students. It is been observed that due to the phobia of updating these varied details people at times visit inappropriate website Fafsa.com - a non government institute. They end up paying $ 80 for utilizing the financial aid finding services. Instead they should be visiting http://www.fafsa.ed.gov/ which happens to be FREE.

Which are various kinds of Financial Aid?

FAFSA gives you access to various financial aid in varied fields. We have enlisted four most widely known:

- Federal Perkins Loan – A loan with 5% interest rate - similar to the Stafford which is lent straight by the schools that are Title IV-eligible to students.

- Pell Grant – Funding of up to $5,550 to students with a little EFCs.(Expected Family Contribution)

- Stafford Loan - subsidized and unsubsidized loans

- Interest is 6.8% and mounts up onto the outstanding balance – Unsubsidized

- Interest is lower (3.5%) - paid by the government - Subsidized

- Federal Work-Study Program – Students here get part-time employment entitled to a certain extent of earning. The federal government remunerates the schools against the number of hours rendered and in turn the school pays the student's wages.

Who is Eligible for FAFSA?

Usually all the students are eligible for some or the other form of financial aid. Those who fall short for need-based aid might have the opportunity to grab an unsubsidized Stafford Loan, irrespective of the income or conditions.

Enlisted are the eligibility criteria for this financial aid:- Males – 18 to 25 – Registered with the Selective Service System (for Conscription in the United States)

- Those who are U.S. citizens, U.S. nationals, and if non citizen but eligible

- Those with valid Social Security number

- Those with a high school diploma or GED

- Duly files up the FAFSA procedures with a promise to use any federal aid for education purpose only

- Those who do not have outstanding refunds for any federal student grants

- Those who are not defaulters in any of the student loans availed

- Those who have clean chit, i.e. who are not accused of sale or possession of illegal drugs while the transit of federal aid

Federal student loans are as good as any other loans, including mortgage or car loans. Individuals are supposed to repay the student loan irrespective of your financial condition is in a turmoil. These are the loans which usually can't be written off in case of bankruptcy or can't be canceled for a reason that the one who availed this loan didn't get the education or job he/she dreamt off. Even in cases where the student did not complete the education it cannot be cancelled, unless and until the school shuts down.

Why Should I Complete a FAFSA?

A lot of students and parents with sound financial conditions face this question" we have a higher income and so we won't qualify for FAFSA; so why should we take all the pain to apply for it?" Enlisted find some of the reasons for the benefit of all:

- One cannot be sure of qualifying or not qualifying unless and until one completes the formalities. FAFSA being a multifaceted aspect and hence some of it might impact one's Pell Grant eligibility. People who are married, have dependents, or earn income other than from work (such as certain types of government assistance) are the best examples of individuals falling in this segment.

- Individuals are required to complete the FAFSA, even for those who are sure that they won't qualify for Pell Grant. IT is so because, if one wants any subsidized or unsubsidized Stafford loan, then FAFSA is mandatory.

- It is the FA Administrator who can help you out with your Pell Grant eligibility and income accordingly. It is a fact that FAFSA is purely based on the recently completed year's income; but in case it is not appropriate/inappropriate then there are chances that your present condition is taken into consideration to sort a way out of it.

Any of the above reason is enough for anyone to always fill out the FAFSA. Qualifying for the minimum amount will ensure you to not to worry about that much amount to be repaid. It is the college grants and scholarships, which will help you to take care of your tuition fees up to some extent. There is no harm in trying for it. It's free money for college education at free of cost initiative, so go for it!

Filling out FAFSA 100% accurate the first time is mandatory - and only your FA administrator knows if it can be worked out and how.

What is the FAFSA filing deadline for 2013-2014?

- 2013-2014 Federal dead line for online FAFSA filing is midnight Central time on June 30, 2014.

- Midnight Central Time on September 24, 2014 is the dead line for submission of corrections/updates.

States are likely to have varied STATE FAFSA DEADLINE

Hand in hand, all are advised to check with the institutions one is considering or in some cases the current institution you are attending which will ensure that you don't miss the FAFSA deadline. Student aid deadlines are treated on priority by authorities at your institutes.

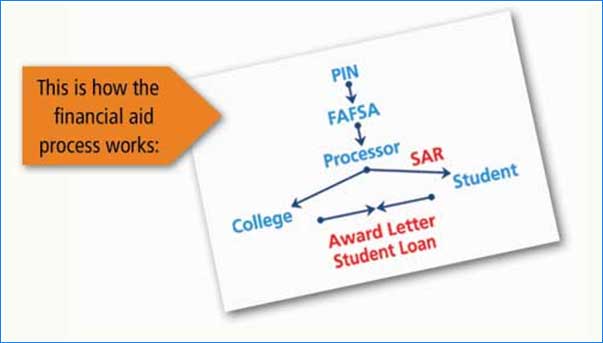

What is the process – step by step for filling up FAFSA?

In spite of all the facilities provided usually a quite a few students are not able to enjoy the benefits of financial aid opportunity just due to the reason that they did not make it in the prescribed deadlines or the lack of knowledge as to how to go about it. Online student's guide to free application for federal student aid (FAFSA) also known as financial aid application guidelines, is also available. Financial Aid awards which re heavy on grants (no or less needs to be repaid) and lighter on loans are usually given away to the early bird candidates.

-

Getting started – what are various FAFSA filing options?

One can initiate the process by mid- November. Online facility is also available at http://www.fafsa.ed.gov/ which can be filed by the 1st of January of the year in which you are planning to commence your college (January 1, 2014, for students wanting to start college in September, 2014). As mentioned earlier, early birds are rewarded well and hence it is advisable to do it at the first convenient opportunity. Aid is provided till they run short of it - late comers get nothing.

-

What is personal identification number [PIN]? How to receive PIN? How to get PIN reissued?

PIN stands for the personal identification number - a code provided by the U.S. Department of Education and utilized to identify the individual on-line. The PIN allows:- FAFSA status update and result of the filed application on FAFSA website

- Electronically – Sign or alter your FAFSA on the web

- Helps one to access the National Student Loan Data System (NSLDS) Web Site for information to your Federal Student Financial Assistance

-

Gather your papers

Keeping in mind the fact that early birds receive the maximum aid possible, initiate working with your parents and collecting the necessary financial records by the winter holidays. For better and easy access students are advised to maintain paperwork and information into two separate folders:

- Income and Expense Information

All income and expense data come from the previous year (2012 for the 2013/2011 award year)

Financial records and update that needs to be collected:

- Taxable income for both parents and student

- Wages

- Pensions

- Capital gains

- Interest

- Dividends

- Annuities

- Unemployment compensation

- Alimony received

- Rent collected

- Business income

- Non-taxable income for both parents and student

- Child support received

- Deductible payments made to a retirement plan (such as an IRA or Keogh)

- Earned income credit.

- Housing and food allowances

- Tax-exempt interest income

- Untaxed income from pensions and annuities

- Untaxed Social Security benefits

- Veterans’ non-education benefits

- Welfare benefits (excluding food stamps)

- Workers’ compensation

- Expenses Paid - Income tax and child support

- Taxable income for both parents and student

- Asset Information

Individuals are supposed to report the net worth of all the assets as on the date of signing the form. This makes it mandatory for all that before they record any totals they are done up with paying off all the bills followed with any consumer debt including credit card balances and so on.- Checking the accounts held under the names of parents and the applicant for Cash and Savings

- Parent's and Student's investment's net value - excluding retirement plans

- Stocks

- Bonds

- CDs

- Money market funds

- Mutual funds

- Commodities

- Trust funds

- Education IRAs

- State-based college savings plans (except pre-paid tuition plans)

- Real estate holdings (rental property and second homes)

- Net worth of family business and/or farm - except the ones which are principal residences

- Income and Expense Information

-

FAFSA calculator

Individuals who are seeking a FAFSA Calculator for 2013 - 2014 Academic Year

On the alert parents are usually keen on assessing the expected family contribution (EFC), which is calculated on FAFSA so as to get a feeler of the financial aid that they may require. It may be calculated as:

* EFC = Parent's Contribution from Income and assets (as adjusted if more than one family member in college) + Student contribution from income and assets -

Be accurate

Accuracy is the prime necessity while completing the FAFSA.- You may end up with a returned application due to minor errors including cases where you mentioned yearly amounts where monthly were required, checking the ovals and not filling it and writing in the margins.

- For questions which seem confusing one can surely get in touch with the federal student aid hot line at 800-4-FED-AID, or seek assistance from a guidance counselor or financial aid administrator.

- A few of the colleges have introduced toll-free numbers for such issues.

- If the issue still persists one can go ahead writing in a letter explaining the issue to school's financial aid administrator.

- Chances of making errors for online applicants are very less as FAFSA on the Web assists with online help, detailed instructions, and work sheets followed with an inbuilt tool that helps to edit the application to avoid errors and decrease the rejections.

- One can also try the option of using the FAFSA4caster at www.fafsa4caster.ed.gov

Answering all the questions is mandatory unless FAFSA particularly tells you to skip any specific question.

Facts and Figures required for each section:- Student name, rank, and serial number – Question 1-17

Covers the personal basics:- Student's name

- Social Security number

- Permanent phone number

- Permanent address

- Marital status.

- E-mail address

- Driver's license number

- Date of birth

- Citizenship status

- Student background – Question 18-31

- Applicant's educational plans.

- Highest level of education attained by applicant's parents

- The student's state of legal residence

- Specifications on the type of aid the applicant wants; loans and/or work study. Indicating the will to accept loans and work-study increased the chances of getting an aid.

- Males in the age group of 18-25 years need mandatory registration for the Selective Service (military) for receiving the financial aid.

- Drug offenses might lead you to a status of INELIGIBLE

- Student income and assets – Question 32-34 & 35-47

Questions 32–34 are basically about the tax filing status. If situation permits - ensure to file up your return before you initiate this segment of FAFSA. Usually the details are the same i.e. adjusted gross income followed with U.S. income tax paid and finally the number of exemptions.

Applicant's income and assets are covered under question 35–47. Not all the questions are applicable for dependent students. Here applicants should enter "0" without fail. All questions if are not answered may lead to a "request for additional information.'' This might delay the entire process. - Dependent vs. independent Question 48-54

Student's dependency status is gauged through these questions. Applicants meeting this criterion are allowed to skip and go to Step 4—you're an "independent" student, where qualifying factors for financial aid are determined without taking in consensus applicant's parents' income and assets.

Factors deciding your status as "INDEPENDENT":- 24 years and above via December 31 of the academic year

- Graduation or a professional student in the academic year

- Married (or separated).

- Applicants supporting Parents/dependents meeting half their expenses

- Orphans or ward of court

- A expert from U.S. Armed Forces

- Grandparents

- Same-sex parents

- Unwed parents

- Common-law parents

- Parents' personal data Question 55-69

Dependent students are supposed to provide enlisted details about their parents:- Marital status

- Social Security numbers

- Number of household members (including the number who will be enrolled in college at least half time)

- State of legal residence

- Age of the older parent

Aforesaid details play a major role effecting the calculation for your Expected Family Contribution (EFC) and hence it is necessary to update the details very carefully.

As a part of the draft 2014-2015 FAFSA, basis a recent announcement by the U.S Department of Education, FAFSA may be providing an alternative where the applicants will be in a position to portray the household status as "unmarried and both parents staying jointly". This is in addition to the option where applicants are also allowed to specify if they belong to a homosexual household.

- Parents' tax filing status Question 70-72

As mentioned earlier in this article; it would be a better option to finish off the tax filing task before initiating this process as the next three questions are pertaining to the applicant's tax filing details. Usually the colleges need the signed tax return copy for your family which will help them to assess that whether your FAFSA number is within the range of tolerance level of $400.

For applicants who are out of this range as required to do alterations to their form and get it reassessed which is a time consuming task. This might jeopardize your efforts and one may end up losing valuable funding.

- Parents' income and assets Question 73-83

It will be a good thing if the applicants are extra cautious while updating details about their parental income and assets and also whether it is been earned by two people or one; in these questions. Additional earning is a possibility with two earning members in the family which enhances the eligibility of the applicant for financial aid.

Question 78-79- Worksheets to collect data of Adjusted Gross Income (AGI)

- Child Support paid

- Taxable work study earning

- Scholarship aid

- Hope Tax Credits

- Life time earning Credits

- Independent students only

Applicants who select their status as Independent need to answer:- Total number of people in their family

- Number of family members getting enrolled as college students in the coming academic year

- List your colleges Question 86-97

The best part of the process is that the applicants are supposed to file for FAFSA only once irrespective of the fact that they may apply to various colleges. These questions are typically designed to extract information from applicants on which all colleges are into consideration and what would be the accommodation plan for each one of it…i.e. while they are studying they would want to do it off campus, on campus or they would live with their parents. This data then flows to the administrator enabling them to assess the accurate cost of attendance

Federal School code search may play the most important role in the entire exercise. It is required to make sure that your details flow in to the correct- selected school of the applicant. These codes are available for the benefit of all at the FAFSA website or with the high school guidance authority. In case of non availability of the school codes; update the enlisted as secondary help:

- School's complete name

- Address

- City

- State

- Zip

- Sign and date the form

Once the applicant has filled up the entire form, they need to sign and date the form appropriately. By doing this they adhere to the terms and conditions with regards to providing the required documents including tax returns and so on. Here they also declare that they are in no way defaulters to any federal loans and will utilize the received financial aid for educational use only.

Anyone else filing the form on applicant's behalf needs to sing and date the form.

What happens next?

Student Aid Report widely known as SAR is received by the families in three to four weeks post applying for FAFSA. For applicants who have filed online or had mentioned an Email address on the form are likely to get a online link to SAR online. This online link gives you the details about your contribution towards the college cost known as EFC, based on the details mentioned while filing FAFSA. The same details will be shared with the colleges one would have considered, home state's scholarship agency for state student aid.

Students might think that I submitted my FAFSA well in advance, I got a mail from them saying it’s been processed, but it’s a long time now but have not heard from them anything about it. Also whenever I check the status on website it says "Current Application Status: Processed Successfully" …Have I goofed up anywhere…?

It’s a big “NO”. Chances are less that you will hear from FAFSA website. If the status is Application processed…which means your information may be sent to the school(s) of your choice and you are supposed to deal with the schools from here on.

Which are the COMMON ERRORS?

On the basis of observations carried out for the past few years; enlisted are the questions where maximum applicants tend making a mistake and get in the loop of reapplying for federal student aid:- List your earnings correctly - Question 86

- Know what assets count - Question 89

- Value real estate correctly

- Don't list your business if you don't have to - Question 90

- If divorced, which parent fills out the form?

No need to mail tax return copy to FAFSA/Colleges - unless asked for by the authorities.

What is the process of Renewal?

Applicants who would have already applied for 2013-2013 financial aid would have received a reminder from the Federal Processing Centre. Existing applicants don't need to clear FAFSA renewal reminder eligibility segment. The Email is sent to ring a bell that one needs to reapply if required with the help of their PIN. Please refer DEADLINES above… There is no other Renewal form for FAFSA. Renewal eligible students are offered to agree the processor to "pre-fill" the application on the basis of details from previous year.

What are the options of repayment?

The Federal department offers enlisted - various options for repayment of College or Career school aid:- Loan consolidation

- Deferment and forbearance

- Standard repayment plan

- Graduated repayment plan

- Extended repayment plan

- Income-based repayment plan (IBR)

- Pay as you earn repayment plan

- Income-contingent repayment (ICR) plan